Recursos

Logotipos

Child Care Property Tax Relief FAQ

Why is property tax relief important for child care providers?

After staffing costs, facilities are the second most expensive part of running a child care center. Property tax relief for child care centers will help centers stay afloat without passing costs on to the working parents they serve.

¿Cuáles son los criterios de elegibilidad?

Para ser elegible para un recorte de impuestos a la propiedad, los proveedores de cuidado infantil deben participar en el programa de becas de cuidado infantil de la Comisión de la Fuerza Laboral de Texas para padres que trabajan. Los proveedores deben mantener la inscripción de al menos 20% de niños becados para ser elegibles.

Will child care providers immediately get a tax cut? What do counties and cities need to do now?

This is a “local option tax” – meaning local governments will have to approve the tax cut under the new law in order for child care providers to get property tax relief. Depending on when cities and counties take action, the tax relief may be applied to 2024 taxes.

Are child care providers that are single location, small businesses eligible for tax relief?

Yes. Child care providers in Texas come in all sizes. Some providers are large corporations operating child care centers in multiple places around Texas. Other child care providers are small “mom and pop” businesses owned by Texans. All types of providers are eligible for tax relief.

¿Cuántos proveedores de cuidado infantil obtendrán un recorte de impuestos? ¿Qué parte recibirán?

The number of child care providers who get property tax relief will depend upon the number of cities and counties who approve the tax cut. Approximately 20% (2,718) of all child care providers in Texas are eligible for tax relief under the new law – but only if their city or county votes to allow for tax relief. Total annual savings for child care providers will vary based on local property values and decisions made by local elected officials.

Will the new law impact funding for public education?

No. Esta enmienda no tiene ningún impacto ni conexión con la financiación de la educación pública. Según la ley estatal de Texas, los votantes locales sólo pueden recortar los impuestos de la ciudad y del condado para los proveedores de cuidado infantil, NO los impuestos escolares.

¿Los recortes del impuesto a la propiedad significarán menores costos de cuidado infantil para los padres que trabajan?

Los costos del cuidado infantil son altos debido a muchos factores. Utilizando los ahorros proporcionados por la desgravación fiscal, los propietarios y directores de guarderías pueden reducir los costos para los padres que trabajan y compensar mejor al personal para reducir la rotación y mejorar la calidad del programa.

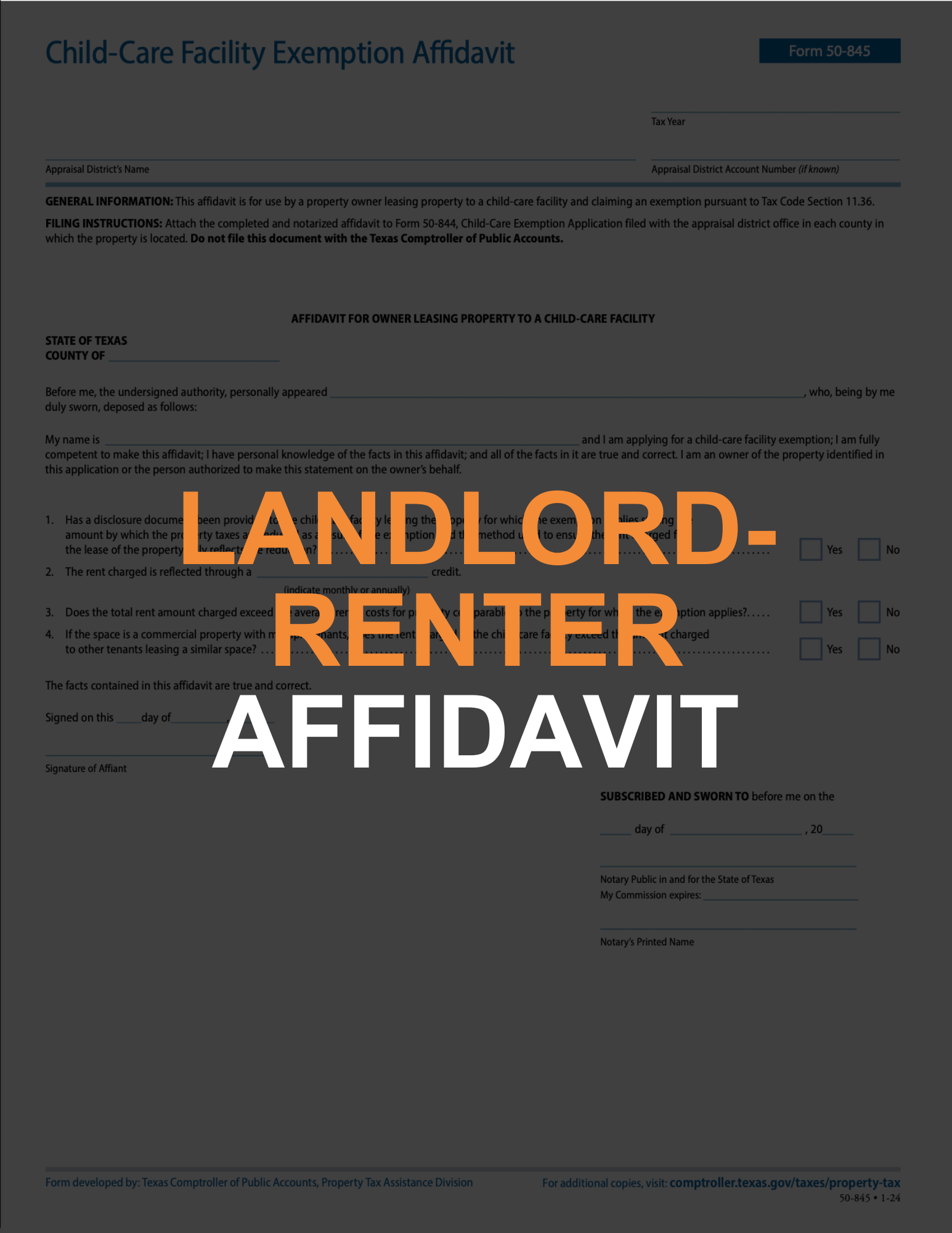

What if a child care provider is leasing or renting their facility?

The Constitutional Amendment would ensure that landlords pass tax savings on to child care providers that rent their facilities. The law requires that the property owners who lease property to child care providers must include with their application for a tax exemption an affidavit to the chief appraiser of the local appraisal district indicating that the property owner has provided to the child care facility a disclosure showing the amount by which the property taxes are reduced and that the rent charged for is reduced by an equal amount. For those properties that are taxed as a single entity, but which are subdivided for tenants or other businesses, the law provides that only the square footage used for a child care center and its activities may be used to calculate the tax exemption by the local appraisal district.

¿Se aplica esta Enmienda Constitucional a los hogares de cuidado infantil familiar?

No. Child care centers operated within homes will receive property tax relief via other mechanisms passed by voters in November 2023.