How to Apply

Webinar Recording + Q&A

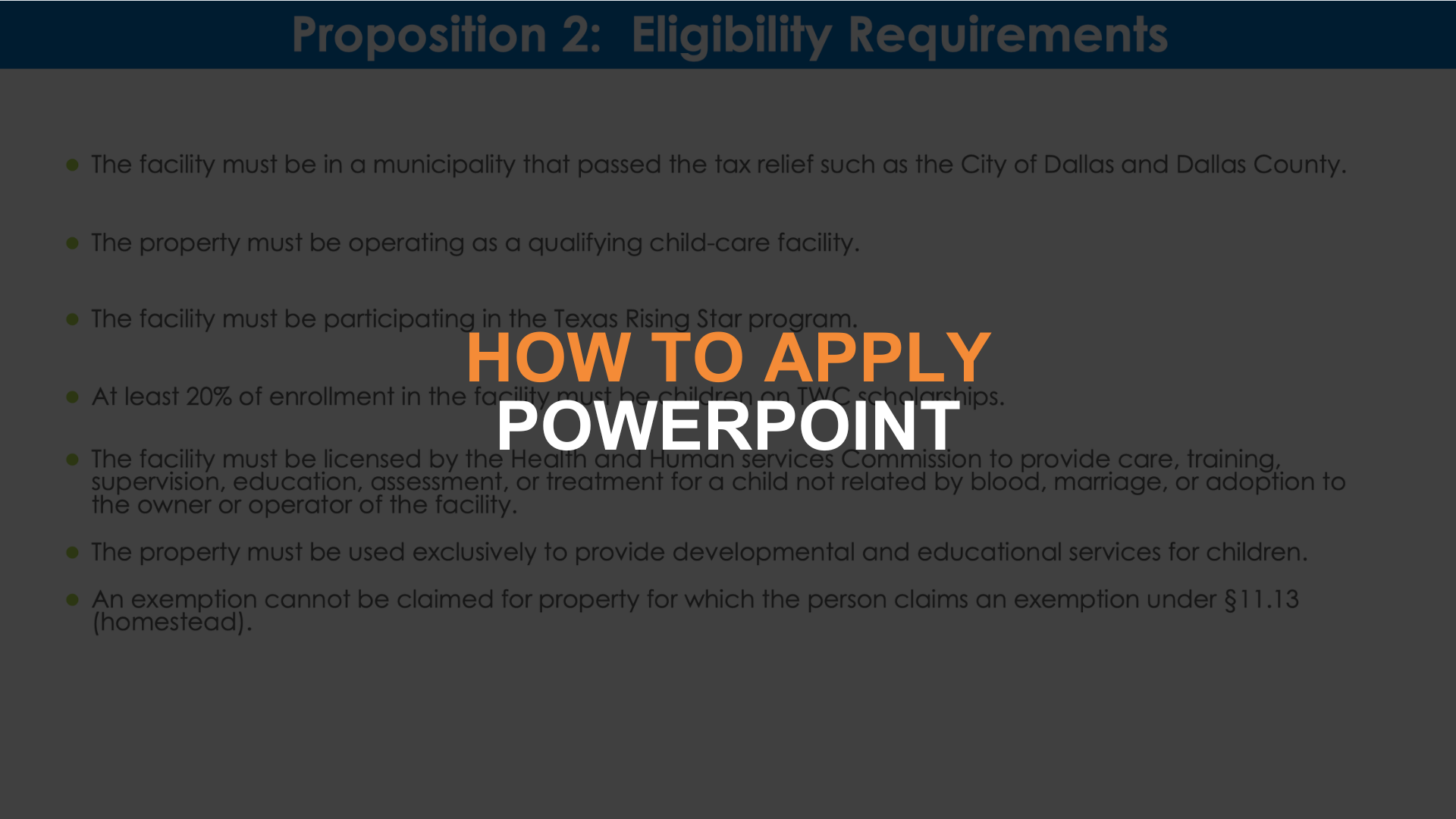

Eligibility Requirements

To qualify for the property tax exemption:

- Your City or County has to have approved Property Tax Relief locally through an ordinance/resolution (Click here for list of cities/counties who have approved it).

- Child care facilities must participate in the Texas Workforce Commission’s Texas Rising Star Program.

- Child care facilities must maintain a minimum 20% enrollment of children receiving subsidized child care services provided through the Child Care Services Program, administered by the Texas Workforce Commission.

Documentation Needed

Applicants must include the following documents with their application:

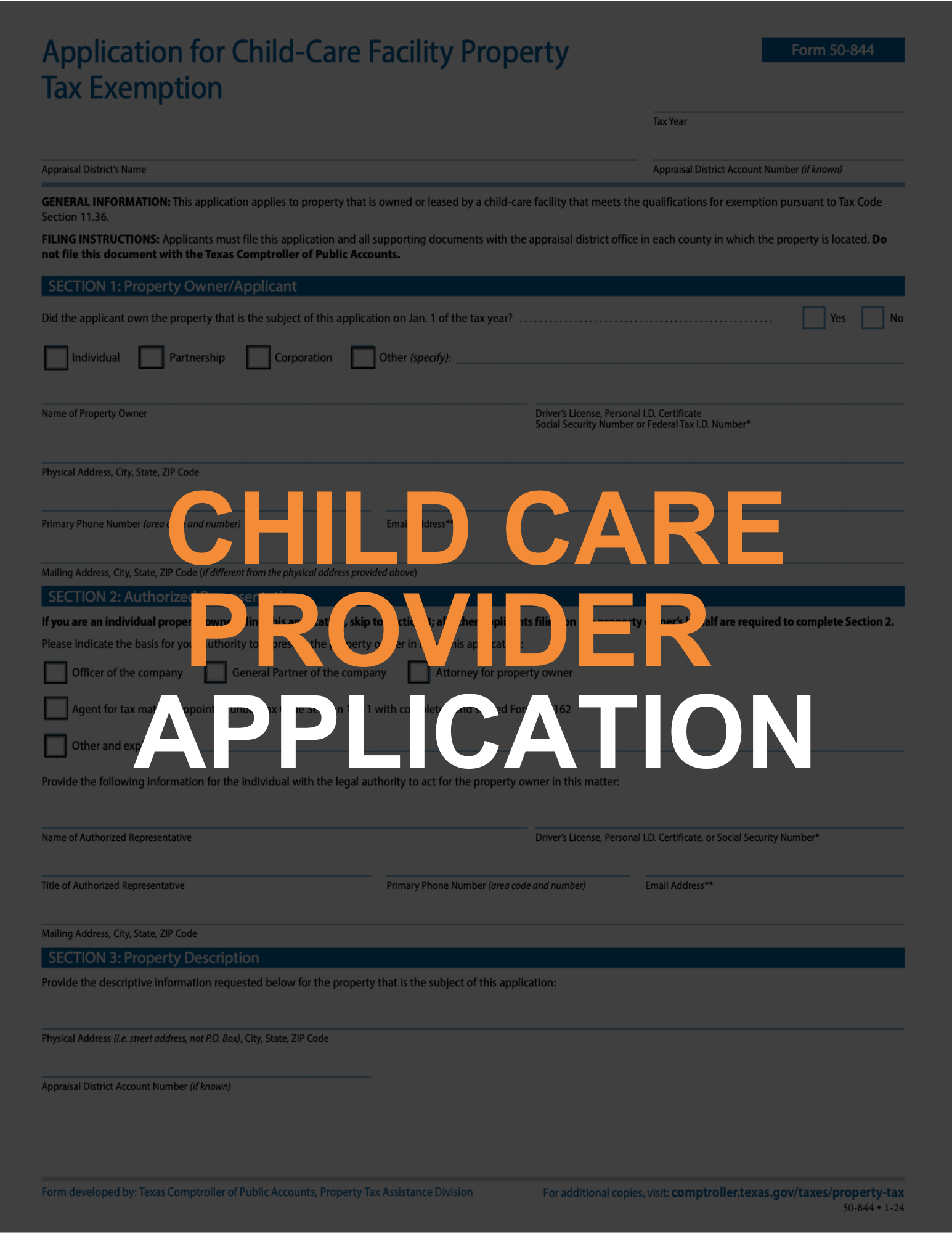

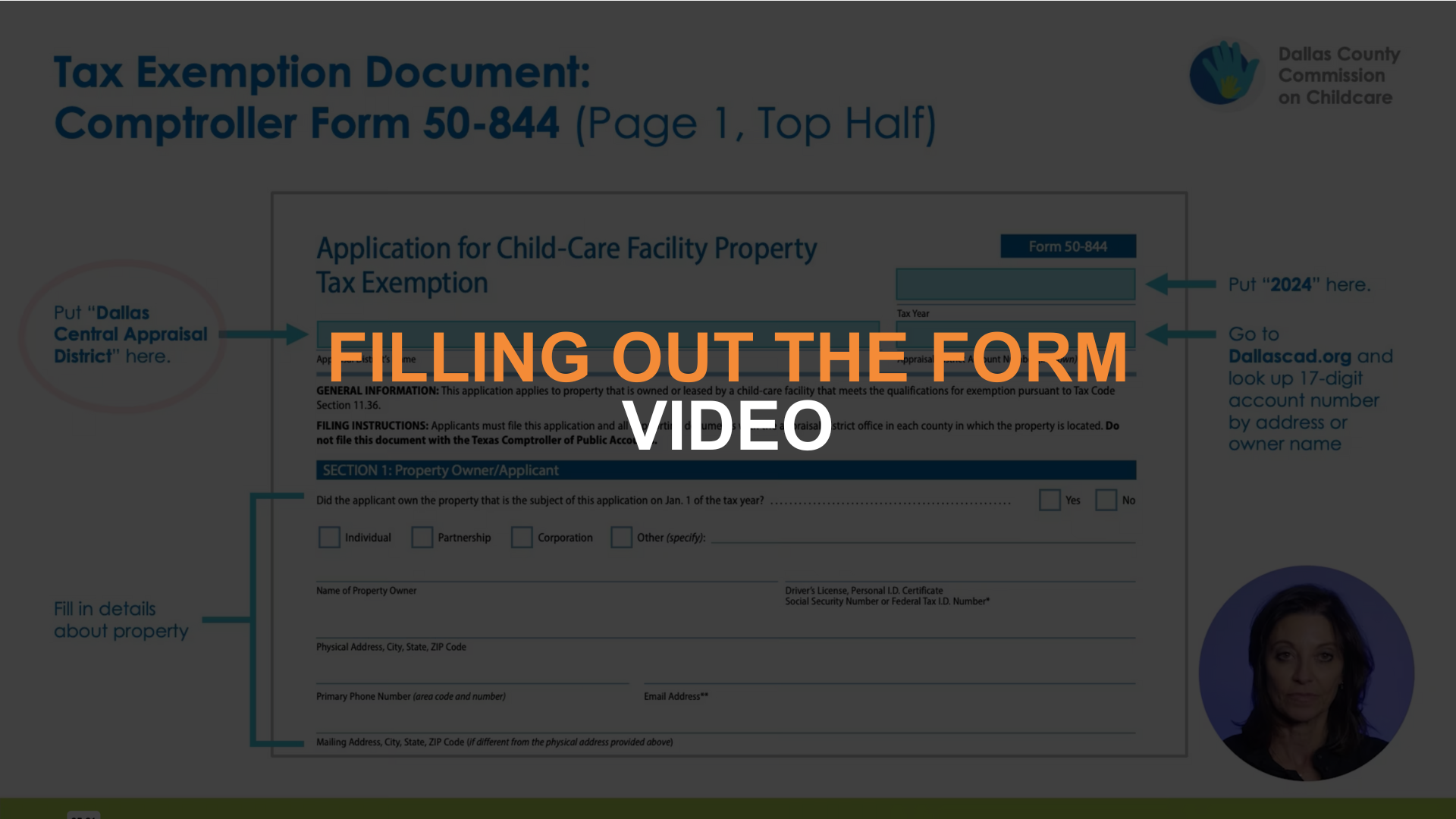

- Child Care Property Tax Exemption Application (Form 50-844)

- Documentation that the child care facility participates in the Texas Workforce Commission’s Texas Rising Star (TRS) Program. Use a picture of your TRS star level certificate or if entry level, your provider agreement.

- Documentation showing that at least 20% of children enrolled in the facility receive subsidized child care services provided through the Child Care Services Program, administered by the Texas Workforce Commission. Use your Child Care Subsidies Payment Report provided to you at each payment cycle as documentation. For backup/further evidence, log into your attendance system and screen shot or take a picture of the list of children receiving subsidies, and submit your current total enrollment.

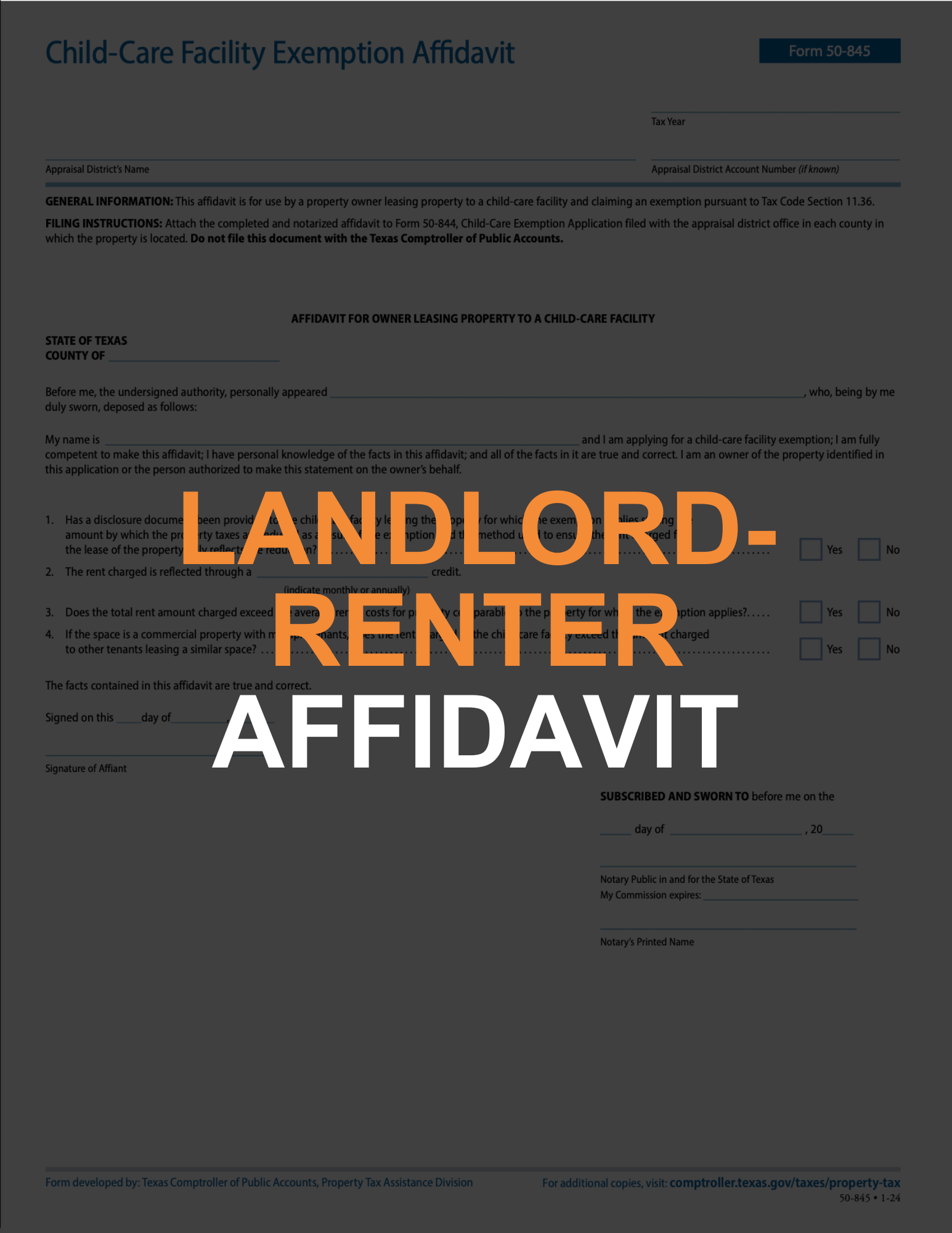

- For a property owner leasing the property to a qualifying child care facility, fill out the Child Care Facility Exemption Affidavit (Form 50-845) certifying that the property owner has provided to the child care facility a disclosure in rent reduction.

Helpful Resources for Providers

Partners across the state have worked on various resources intended to assist child care providers with the application process. We will continue to update this with more resources as we receive them from other cities and counties.

Child Care Provider Application/Affidavit

(Haga clic para descargar)

English / Spanish / Chinese / Vietnamese Here

(Haga clic para descargar)

English / Spanish / Chinese / Vietnamese Here

How to Apply PowerPoint/Video

Where to Submit Documentation

You must submit all required documentation to your local Central Appraisal District. The mailing address will vary dependent on where you live. For assistance in submitting documentation, contact your Central Appraisal District.

Approved Cities/Counties

Below is a list of known cities and counties who have approved Property Tax Relief for Providers (Updated 6/20/24):

- City of Austin

- City of Denton

- City of Dallas

- City of Fort Worth

- City of Houston

- City of San Antonio

- City of Arlington

- City of Kyle

- City of Weslaco

- City of Waxahachie

- City of El Paso

- Aransas County

- Dallas County

- Bexar County

- El Paso County

- Hays County

- Travis County

- Harris County

- Andrews County

- Jefferson County

- Knox County

- Miliam County

- Potter County

- Tarrant County

- Medina County

Questions on how to apply in your local city/county? Reach out to Kim Kofron at kkofron@childrenatrisk.org for further assistance.